Good morning,

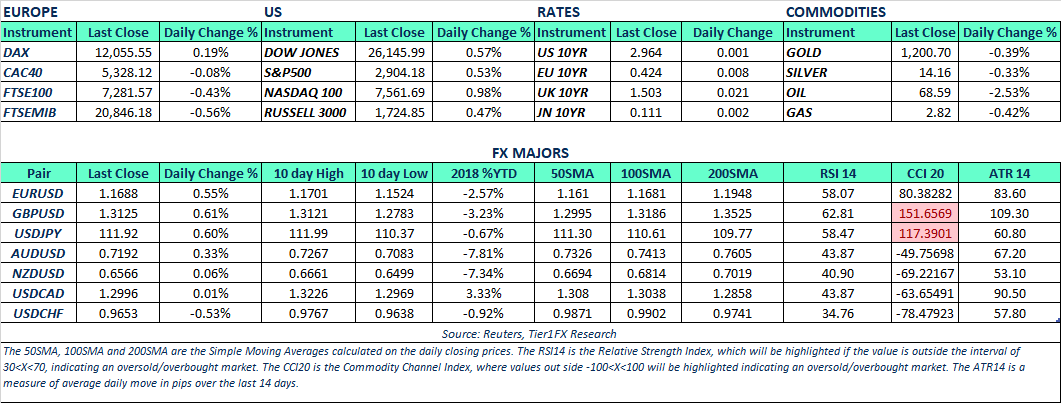

After a mixed session in Europe, where the main focus was on the central bank announcement from the BOE and ECB, US risk sentiment picked up on back some progress in the US-China trade talks. On the macro side, weaker-than-expected US CPI sent the US Dollar on the offer, which helped US exporters gain, sending the S&P500 back above 2,900 chasing the recent all-time highs at 2,916.5. In emerging markets, Turkey hiked interest rates to re-attract flow to the Turkish Lira.

Both European central bank events were quite uneventful on Thursday. For the Euro zone, the European Central Bank kept rates unchanged at 0% for the refinancing rate and -0.4% for the deposit rate as expected and did not make any changes in the communication regarding bond purchases and aiming to raise interest rates in the Autumn of 2019. ECB President Draghi noted that he expects a rise in core inflation due to underlying strength of the economy and a pressure on wages. European labour markets are also overall improving, which should add to the growth, where the latter is seen as broadly balanced.

In the UK, the Bank of England kept rates unchanged at 0.75% as expected despite some market rumours that a rate increase could be possible. The Monetary Policy Committee cast a unanimous 9-0 vote. Domestic economy is seen by the BoE as “on track”. As we are getting closer to the Brexit in March 2019, UK companies are exercising cost control and holds back investments, but still the BoE decided to raise growth expectations for Q4 to 0.5% from 0.4%. Neither the Euro nor the Sterling reacted much to the central bank announcements. The Pound is set for its biggest weekly increase in 2018.

From the US, the August Consumer Prices were released, showing a Core CPI YoY at 2.2% – 0.2%-points below expectations at 2.4%. The Headline CPI also disappointed both monthly and yearly. The underlying statistics showed the disappointment was due to declines in healthcare and apparel costs as well as slowing underlying inflation pressures. That said, there should still be an upward pressure on general prices in the US due to the strong labour market, where the weekly jobless claims now are close to 49-year lows.

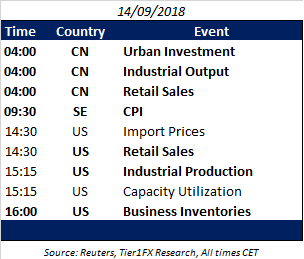

Today, we have another interesting day ahead with the macro calendar as follows:

On the technical side, EUR/USD daily price action showing a break above trend resistance projected from April 2018 highs and 100-day SMA. Currently, the pair has tested the fibo retracement level in the wave from 2018 April highs – 2018 lows at 1.1725, where a break above could give scope for a test of July highs at 1.1790.

Have a nice weekend!