Important notes about EPM

- You can only set your EPM after your account has joined the Managed Program.

- You can remove the EPM by setting its value to zero

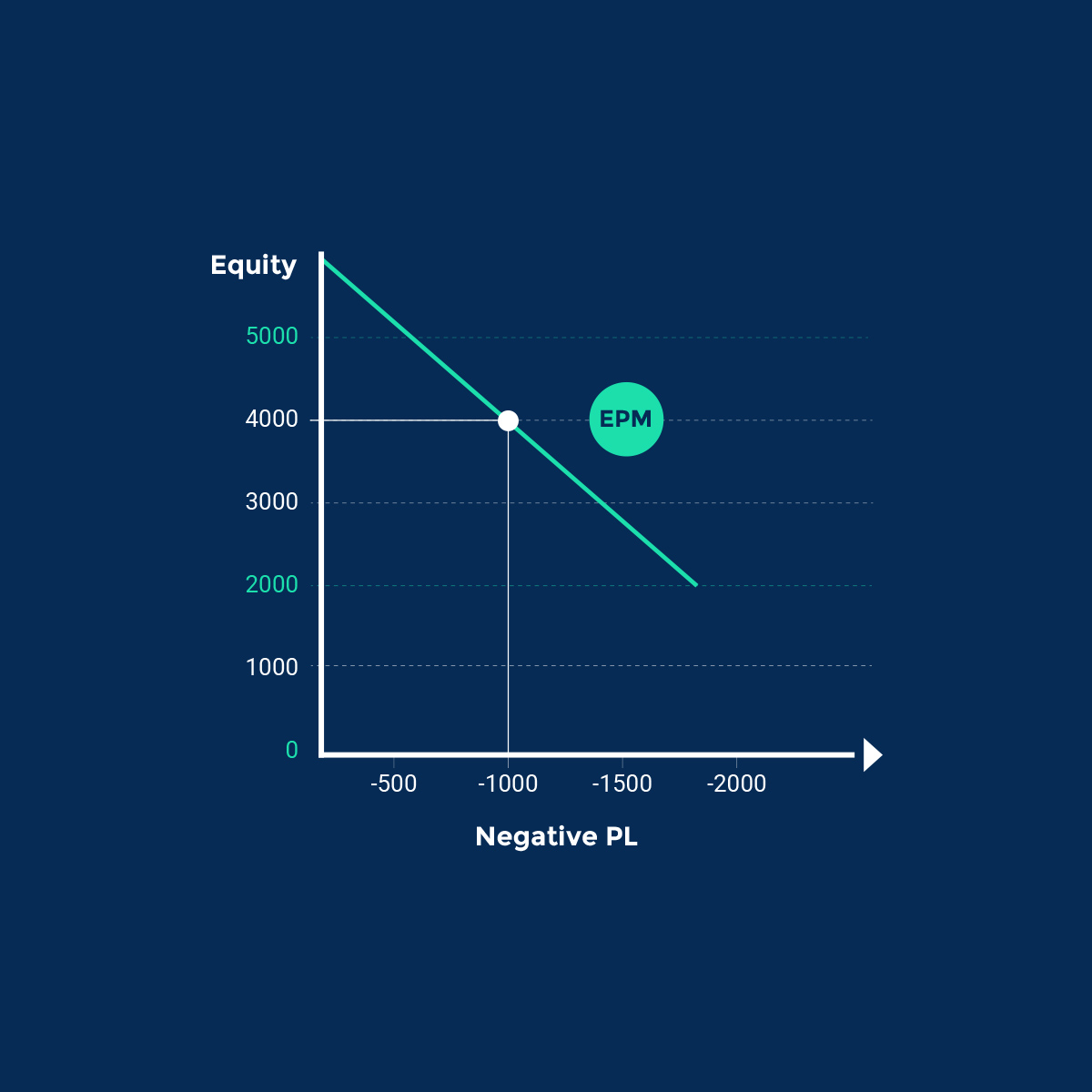

- Take care when making EPM adjustments if you have open positions, as you may accidentally set your EPM at a lower level than your current equity and thus trigger it.

- Remember to take EPM into account when making new deposits or withdrawals.

- EPM is a third party trading solution. During volatile markets, your trading account may incur larger losses than the specified EPM level.